Forex Tramp EA – Multi-Currency With Soft Martingale Free Download: Honest Review & Safe Insights

4

Introduction to Forex Tramp EA – Multi-Currency With Soft Martingale Free Download

The keyword Forex Tramp EA – Multi-Currency With Soft Martingale Free Download has gained attention among forex traders searching for automated systems that can trade multiple currency pairs while controlling risk. At first glance, this Expert Advisor (EA) promises a balance between profitability and safety by using a soft martingale approach instead of aggressive lot multiplication.

Automated trading systems like this are popular because they remove emotional decision-making and operate 24/5 without fatigue. However, not all EAs are created equal. Some perform well only in specific market conditions, while others may hide serious risks behind impressive backtests.

This article offers a clear, educational, and unbiased overview of Forex Tramp EA—how it works, what “soft martingale” really means, its advantages, drawbacks, and what you should know before looking for a free download.

What Is Forex Tramp EA?

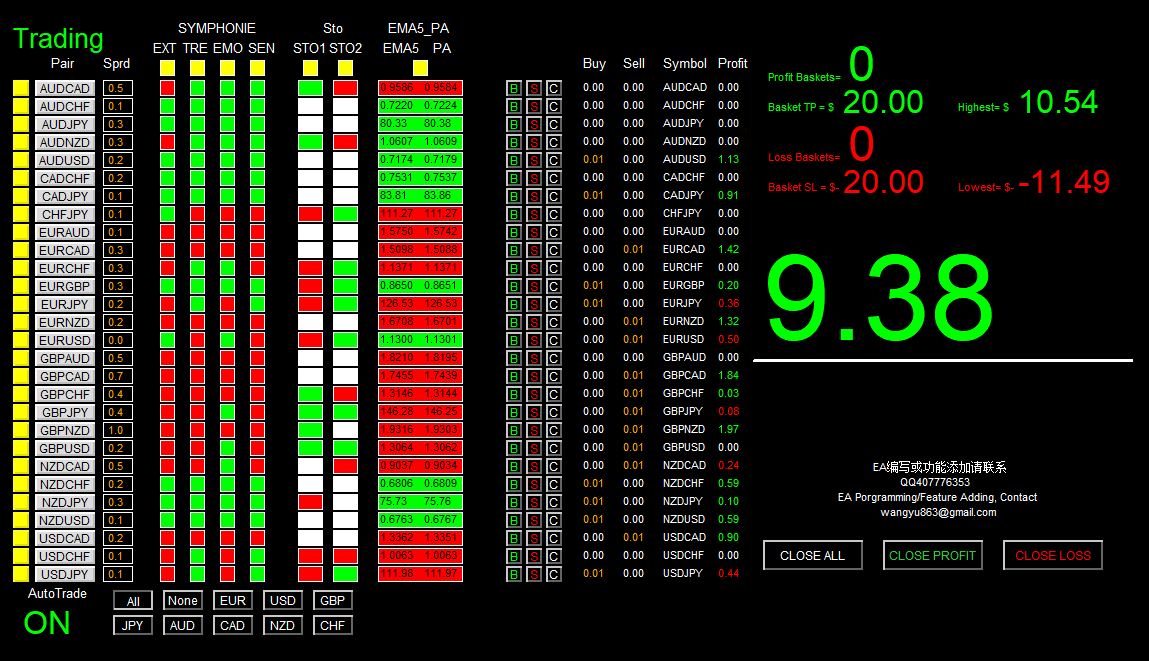

Forex Tramp EA is an automated trading robot designed for the MetaTrader platform. Its main selling points include:

- Multi-currency trading capability

- Automated trade entries and exits

- Use of a soft martingale money management strategy

- Minimal manual intervention

Unlike single-pair EAs, Forex Tramp EA scans several currency pairs simultaneously. This diversification can reduce dependency on one market condition, which is appealing to both beginner and intermediate traders.

How the Soft Martingale Strategy Works

Understanding Soft Martingale in Simple Terms

Traditional martingale strategies double the lot size after every losing trade, which can quickly wipe out an account. Soft martingale, on the other hand:

- Increases lot size gradually, not exponentially

- Applies limits to maximum trade volume

- Often combines trend or filter indicators

This means Forex Tramp EA aims to recover losses more cautiously, making it less risky than classic martingale systems, though still not risk-free.

Why Traders Prefer Soft Martingale

- Lower drawdowns compared to hard martingale

- More sustainable for small and medium accounts

- Better adaptability to ranging markets

Multi-Currency Trading Explained

One of the strengths of Forex Tramp EA is its multi-currency design.

Benefits of Multi-Currency EAs

- Diversification across currency pairs

- More trading opportunities

- Reduced dependence on a single market trend

Common Pairs Used

Typically, EAs like Forex Tramp EA focus on major and minor pairs such as:

- EUR/USD

- GBP/USD

- USD/JPY

- AUD/USD

Each pair behaves differently, helping balance overall performance.

Key Features of Forex Tramp EA

| Feature | Description |

|---|---|

| Multi-Currency Trading | Trades several pairs simultaneously |

| Soft Martingale | Controlled lot size progression |

| Automated Execution | No manual trading needed |

| MetaTrader Compatible | Works on MT4/MT5 |

| Adjustable Risk Settings | User-defined risk parameters |

Pros and Cons of Forex Tramp EA

Advantages

- Beginner-friendly automation

- Reduced emotional trading

- Soft martingale is safer than classic martingale

- Works on multiple currency pairs

Disadvantages

- Still carries drawdown risk

- Performance depends on broker conditions

- Requires VPS for best results

- Free downloads may be unsafe or outdated

Forex Tramp EA – Free Download: What You Should Know

Searching for Forex Tramp EA – Multi-Currency With Soft Martingale Free Download often leads traders to unofficial sources. This can be risky.

Potential Risks of Free Downloads

- Modified or infected files

- Outdated versions with poor performance

- No updates or developer support

- Possible account security issues

Safer Alternatives

- Test on a demo account first

- Use verified EA marketplaces

- Scan files before installation

- Never risk capital you can’t afford to lose

For general trading safety guidelines, you can also refer to educational resources like https://www.babypips.com.

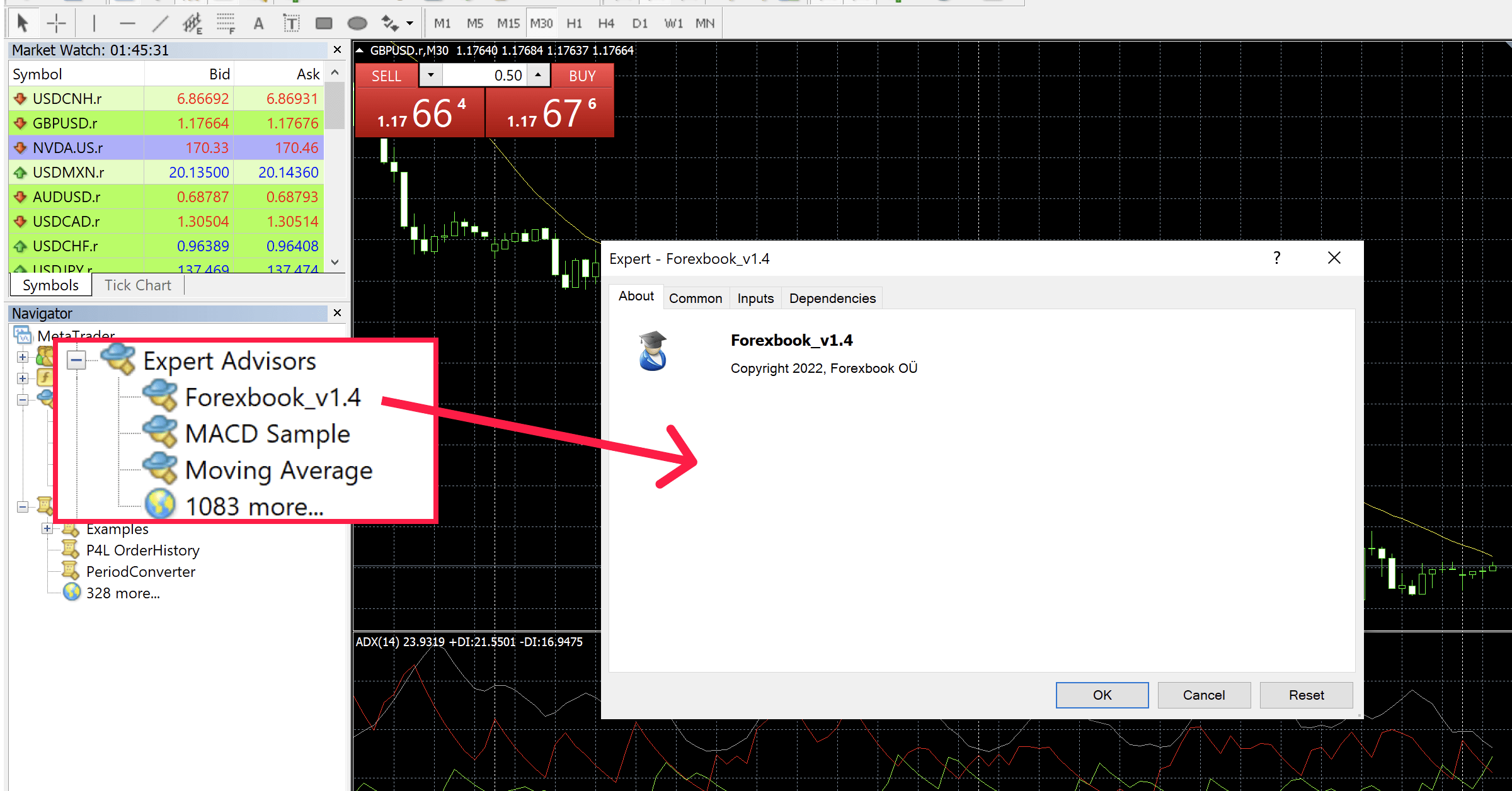

Installation and Setup Overview

- Install MetaTrader (MT4 or MT5)

- Add the EA to the Experts folder

- Restart MetaTrader

- Attach EA to supported charts

- Adjust risk and lot settings

- Test on demo before live trading

Who Should Use Forex Tramp EA?

Forex Tramp EA may be suitable for:

- Beginners learning automated trading

- Traders who prefer hands-off strategies

- Users comfortable with moderate risk

It may not suit traders who avoid martingale-based systems entirely or those seeking guaranteed profits.

Frequently Asked Questions (FAQs)

1. Is Forex Tramp EA safe to use?

It is safer than classic martingale EAs but still carries risk. Always test on demo accounts.

2. Does Forex Tramp EA work on all brokers?

It works best with low-spread, fast-execution brokers.

3. Can beginners use Forex Tramp EA?

Yes, but understanding basic forex concepts is strongly recommended.

4. Is the soft martingale strategy risk-free?

No. It reduces risk but does not eliminate drawdowns.

5. Can I trade manually alongside Forex Tramp EA?

Yes, but it’s better to use a separate account to avoid conflicts.

6. Should I trust free downloads of Forex Tramp EA?

Be cautious. Free versions may be unsafe or outdated.

Final Verdict on Forex Tramp EA

Forex Tramp EA offers an interesting blend of multi-currency trading and soft martingale risk control. While it appears more conservative than many martingale robots, it is not a magic solution. The keyword Forex Tramp EA – Multi-Currency With Soft Martingale Free Download may sound appealing, but traders should prioritize safety, testing, and education over quick access.

Used responsibly, this EA can be a learning tool or part of a diversified trading approach—but never a guaranteed profit machine.