The Trader’s Secret: Making Compounding in Forex Work for You

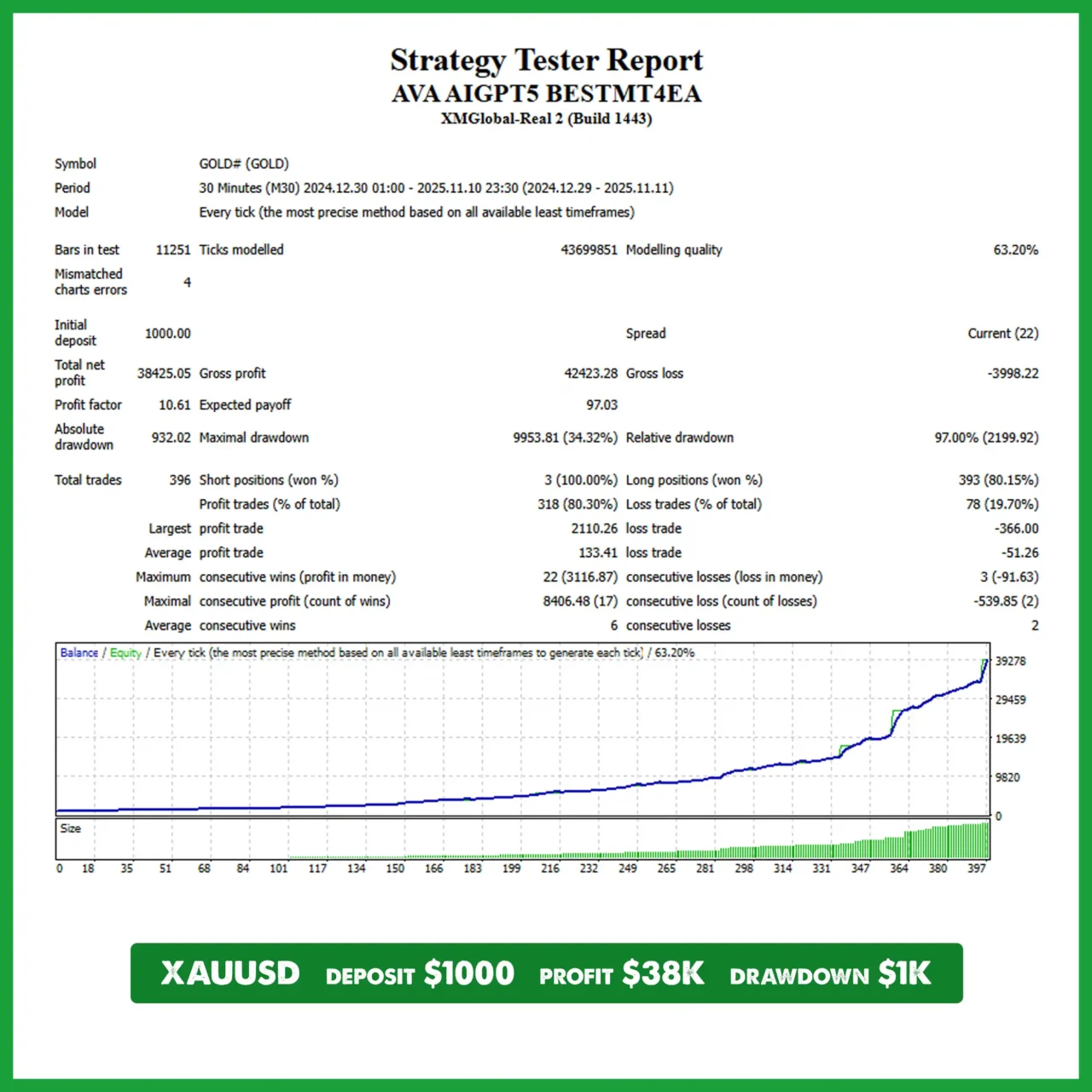

AVA AIGPT5 EA: AI-fueled 4D Nano Algorithm Gold Scalper for MT4

29 in stock

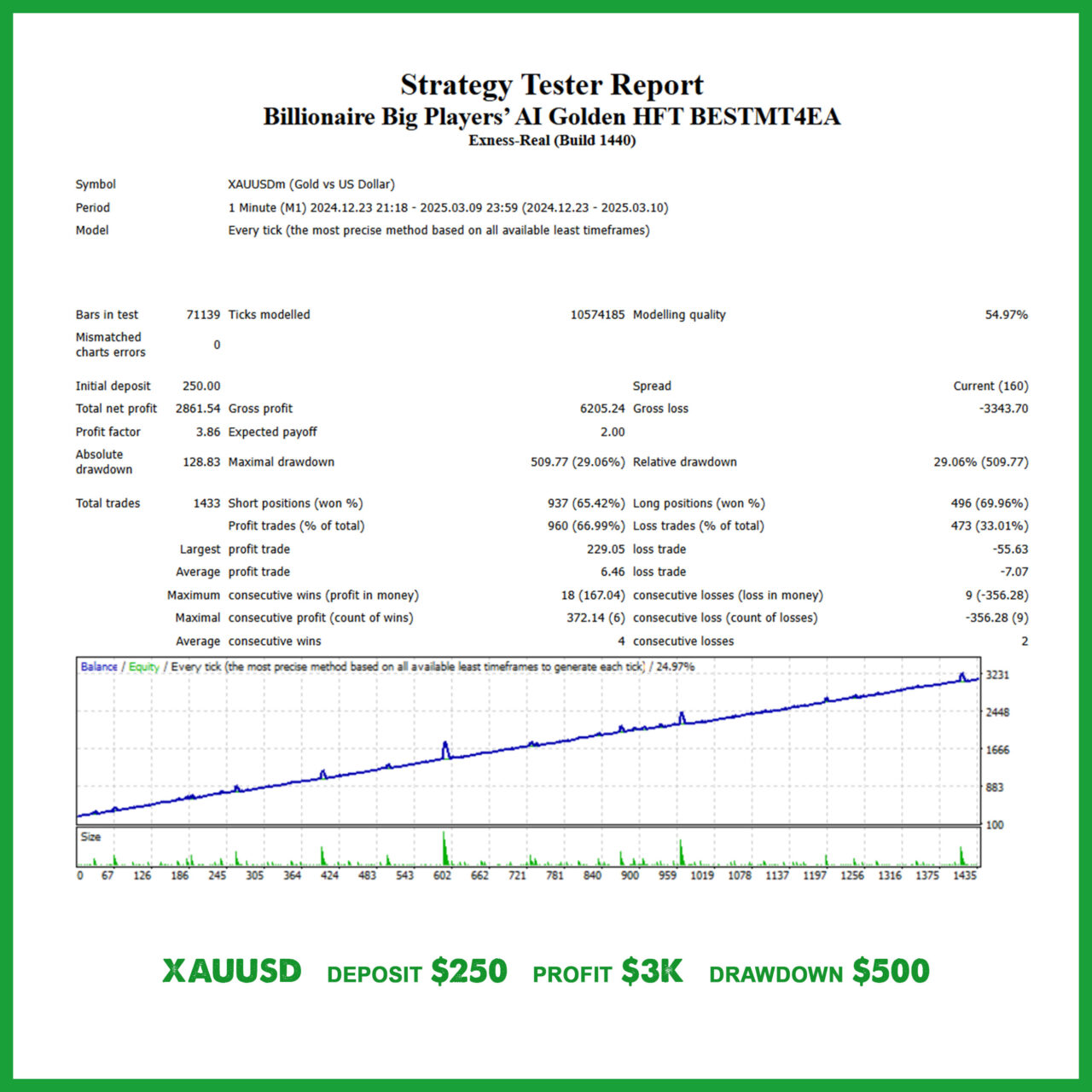

$22.99 – $678.99Price range: $22.99 through $678.99Billionaire Big Players’ AI Golden EA: XAUUSD Scalping MT4

26 in stock

$22.99 – $678.99Price range: $22.99 through $678.99Euro Hedger EA: Automated EURUSD Hedging Robot for MT4

29 in stock

$7.99 – $197.99Price range: $7.99 through $197.99FXCore100 EA [UPDATED]

344 in stock

Gemini AI Smart Trader Pro EA: 4D Nano Scalper for MT4

29 in stock

$18.99 – $567.99Price range: $18.99 through $567.99Golden Deer Holy Grail Indicator (Lifetime Premium)

24 in stock

Horizon BW AI Scalping EA: Semi Automatic Hedging Robot for MT4

29 in stock

$18.99 – $478.99Price range: $18.99 through $478.99Millionaire Bitcoin Scalper Pro EA: AI-fueled 4D Nano Scalper for MT4

20 in stock

$29.99 – $987.99Price range: $29.99 through $987.99Powerful Forex VPS for MT4 & MT5 – Best Price

183 in stock

$44.99 – $359.99Price range: $44.99 through $359.99Top 2000 Trading Tools for Forex Success in 2025 (EA & Indicator)

In stock

Ever met a trader who seems to grow their account almost magically? They might start with a modest sum, and before you know it, they’re trading sizes that make your head spin. What’s their secret? More often than not, it’s not a mysterious “holy grail” indicator. It’s the disciplined, powerful application of compounding in forex.

This isn’t just a dry financial concept. In the hands of a patient trader, compounding is a superpower. It’s the art of turning your profits into your most diligent employees, putting them right back to work. Yeah, it requires discipline—that means no withdrawing your first $100 profit for a fancy dinner. But the long-term payoff? It’s what separates the consistent wealth-builders from the constant thrill-seekers.

Let’s break down how you can harness this “eighth wonder of the world” in your own trading.

What Exactly is Forex Compounding? (It’s Simpler Than You Think)

At its heart, compounding in forex is a straightforward strategy: you reinvest the profits from your winning trades back into your trading capital. Instead of withdrawing your gains, you allow them to increase the size of your account balance. This, in turn, allows you to take slightly larger positions over time, which can lead to larger absolute profits.

Think of it like a snowball rolling down a hill. You start with a small handful of snow (your initial capital). As it rolls, it picks up more snow (your profits). The bigger it gets, the more snow it collects with each revolution. Before long, that small snowball is a formidable force. That’s the exponential growth compounding can offer.

Here’s the key difference:

- Simple Growth: You make 5% on a $1,000 account, withdraw the $50 profit. Next month, you’re still only making 5% on the original $1,000.

- Compound Growth: You make 5% on a $1,000 account, and now your capital is $1,050. Next month, that same 5% return gives you $52.50. It doesn’t sound like much, but give it time—the effect accelerates.

The Math Magic Behind Compounding Your Trades

Don’t worry, we’re not going back to high school algebra. There’s one core formula that shows the sheer potential of this strategy:

Future Value = Principal × (1 + Rate)Time

- Principal: Your starting capital (e.g., $10,000).

- Rate: Your consistent return per period (e.g., 2% per month).

- Time: The number of periods you compound for (e.g., 12 months).

Let’s see this in action. Imagine you start with $10,000 and average a 2% monthly return. In the first month, you make $200. Ho-hum, right? But watch what happens when you reinvest every single profit:

- After 1 year: Your account grows to approximately $12,682.

- After 2 years: That becomes $16,085.

- After 5 years: You’re looking at $32,810.

The real kicker? Without compounding, after one year you’d have just $12,400. That’s $282 left on the table from just the first year alone. That gap widens into a chasm over time.

Your Game Plan: Practical Forex Compounding Strategies

Okay, the theory is great. But how do you actually *do* it? Here are a few battle-tested ways to implement a compounding strategy.

The 10/20 Pips a Day Strategy

This is a classic for a reason. The goal isn’t to catch massive trends; it’s to be consistent. You aim to capture a small, predetermined number of pips each day—say, 10 or 20. The profit from today is then rolled into tomorrow’s trade, slowly but steadily increasing your position size. The key here is a rock-solid risk-reward ratio (like 1:2) and the discipline to walk away once you’ve hit your daily target.

The Asymmetric Compounding Strategy

This one’s for those with a higher risk tolerance and a proven, high-probability system. Here, you dramatically increase your trade size only after a win. For example, you might risk 1% of your capital on a trade. If you win, you then risk 2% of the new, larger balance on the next trade. If you win again, you risk 4%. This can lead to explosive growth during winning streaks, but it requires iron-clad emotional control to avoid giving back all the profits.

Partial Compounding: The Balanced Approach

Who says it’s all or nothing? A very sensible method is to reinvest only a portion of your profits—say, 50%. You take the other 50% as a reward or move it to a savings account. This strikes a beautiful balance between fueling your account’s growth and enjoying the fruits of your labor, all while keeping risk in check.

Navigating the Pitfalls: Risk Management is Non-Negotiable

Let’s have a real talk. Compounding is a double-edged sword. It can magnify your losses just as efficiently as your gains if you’re not careful. Here’s how to stay safe:

- Treat Risk as a Percentage, Not a Dollar Amount: Always risk a fixed percentage of your current account balance per trade (e.g., 1%). This means your position size naturally adjusts as your account grows, protecting you from catastrophic losses.

- Embrace Stop-Loss Orders: Never, ever trade without a stop-loss. It’s your single best defense against a small loss turning into an account-blowing disaster.

- Control Your Emotions: Seeing your account grow can breed overconfidence. Stick to your plan. Revenge trading or abandoning your strategy after a few losses is what derails most compounding journeys.

- Protect Your Capital During Slumps: If you hit a losing streak, it’s okay to dial back. Reduce your position sizes or even pause compounding temporarily to protect the capital you’ve worked so hard to build.

Getting Started: Your First Step Towards Exponential Growth

Feeling inspired? Don’t just jump in. A structured approach is what separates the pros from the rookies.

- Set Crystal-Clear Goals: What are you aiming for? A certain account size in 12 months? Be realistic about your monthly return expectations.

- Create a Detailed Trading Plan: This is your bible. It should outline your strategy, risk-per-trade, and the rules for reinvesting profits.

- Track Everything: Use a spreadsheet or journal to log every trade, profit, and loss. This data is gold for reviewing your performance and staying disciplined.

- Use a Forex Compounding Calculator: Before you even place your first trade, play with an online calculator. It’s incredibly motivating to see the potential growth trajectory based on your own numbers.

The Bottom Line

Compounding in forex isn’t a get-rich-quick scheme. It’s a get-rich-*slowly*-but-much-more-surely strategy. It rewards patience, discipline, and a consistent methodology over raw genius or luck.

The power doesn’t come from making one or two incredible trades. It comes from making a series of good, disciplined trades and letting the mathematical inevitability of compounding do the heavy lifting for you. Start small, stay consistent, and that snowball will start rolling when you least expect it.

What is the best timeframe for compounding in forex?

Compounding is a long-term strategy. While you can compound daily or weekly, monthly compounding is often the most practical and less stressful approach, especially for beginners. It gives you time to analyze your performance and make calm, rational decisions without the frenzy of daily recalculations.

Can I start compounding with a small account?

Absolutely. In fact, compounding is one of the most powerful tools for traders starting with a small account. You can begin with as little as $100 or $500. The key isn’t the initial amount; it’s the consistency of your returns and your discipline to reinvest.

What’s the biggest mistake traders make with compounding?

Two things: impatience and poor risk management. Many traders expect exponential results in a few weeks and give up, or they increase their position sizes too aggressively without adjusting their risk, leading to devastating losses that wipe out their compounded gains.

Should I ever withdraw profits when compounding?

This is a personal choice, but a balanced approach often works best. Many successful traders compound a portion of their profits (e.g., 50-75%) and withdraw the rest. This allows for both account growth and provides tangible income, keeping you motivated for the long haul.

About Daniel B Crane

Hi there! I'm Daniel. I've been trading for over a decade and love sharing what I've learned. Whether it's tech or trading, I'm always eager to dive into something new. Want to learn how to trade like a pro? I've created a ton of free resources on my website, bestmt4ea.com. From understanding basic concepts like support and resistance to diving into advanced strategies using AI, I've got you covered. I believe anyone can learn to trade successfully. Join me on this journey and let's grow your finances together!

View all posts by Daniel B Crane