Is TradingView the Best Charting Platform?

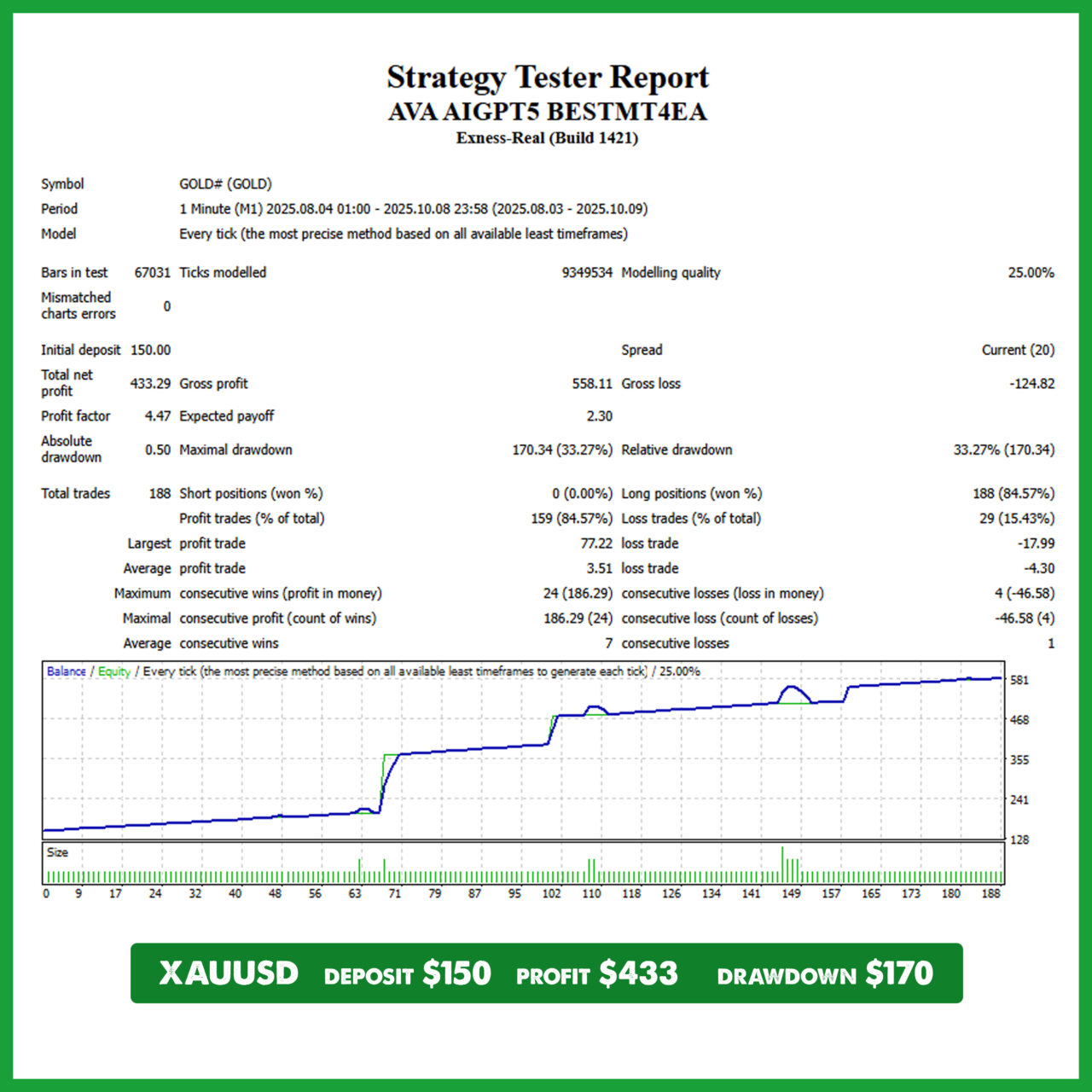

AVA AIGPT5 EA: AI-fueled 4D Nano Algorithm Gold Scalper for MT4

30 in stock

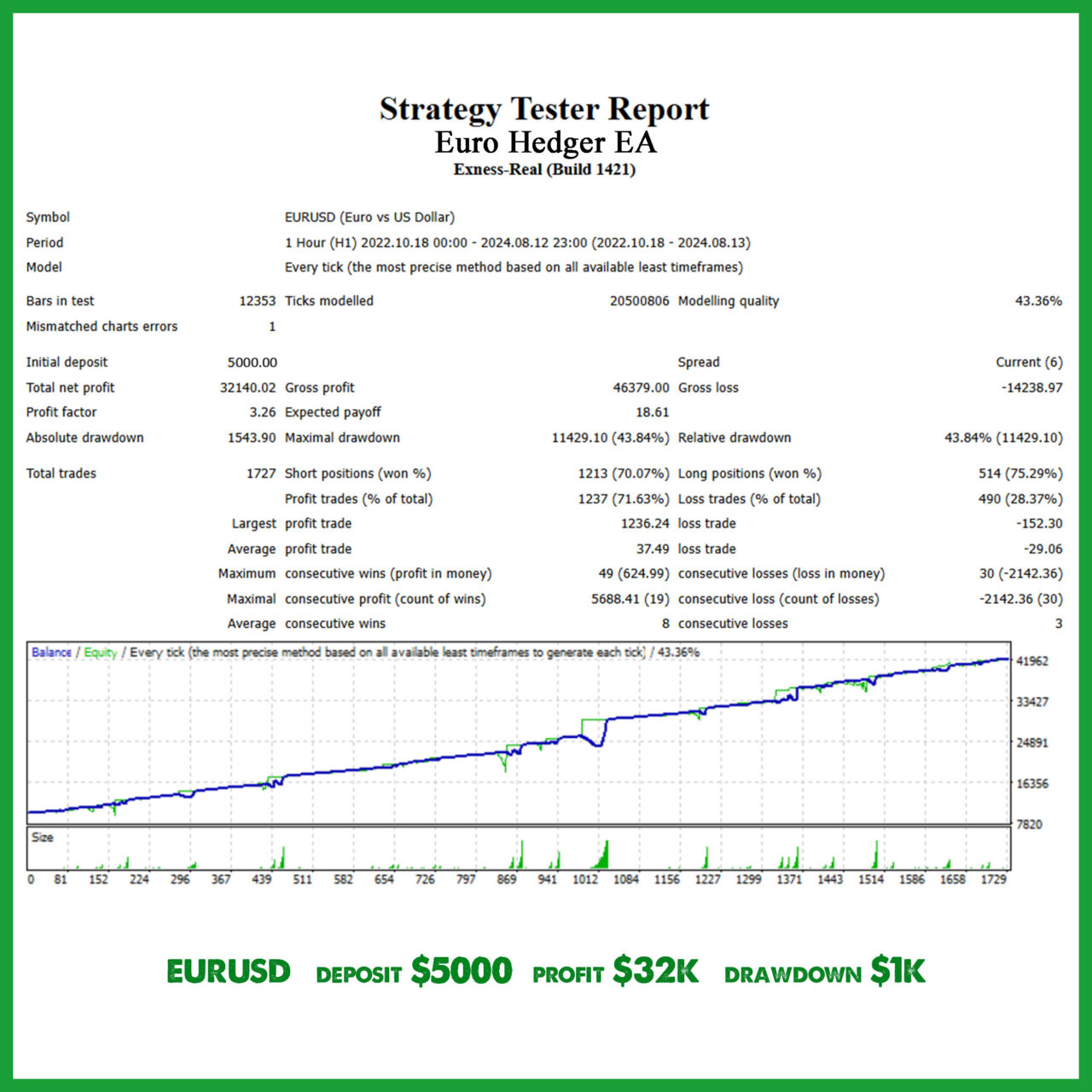

$22.99 – $678.99Price range: $22.99 through $678.99Euro Hedger EA: Automated EURUSD Hedging Robot for MT4

29 in stock

$7.99 – $197.99Price range: $7.99 through $197.99FXCore100 EA [UPDATED]

344 in stock

Golden Deer Holy Grail Indicator (Lifetime Premium)

24 in stock

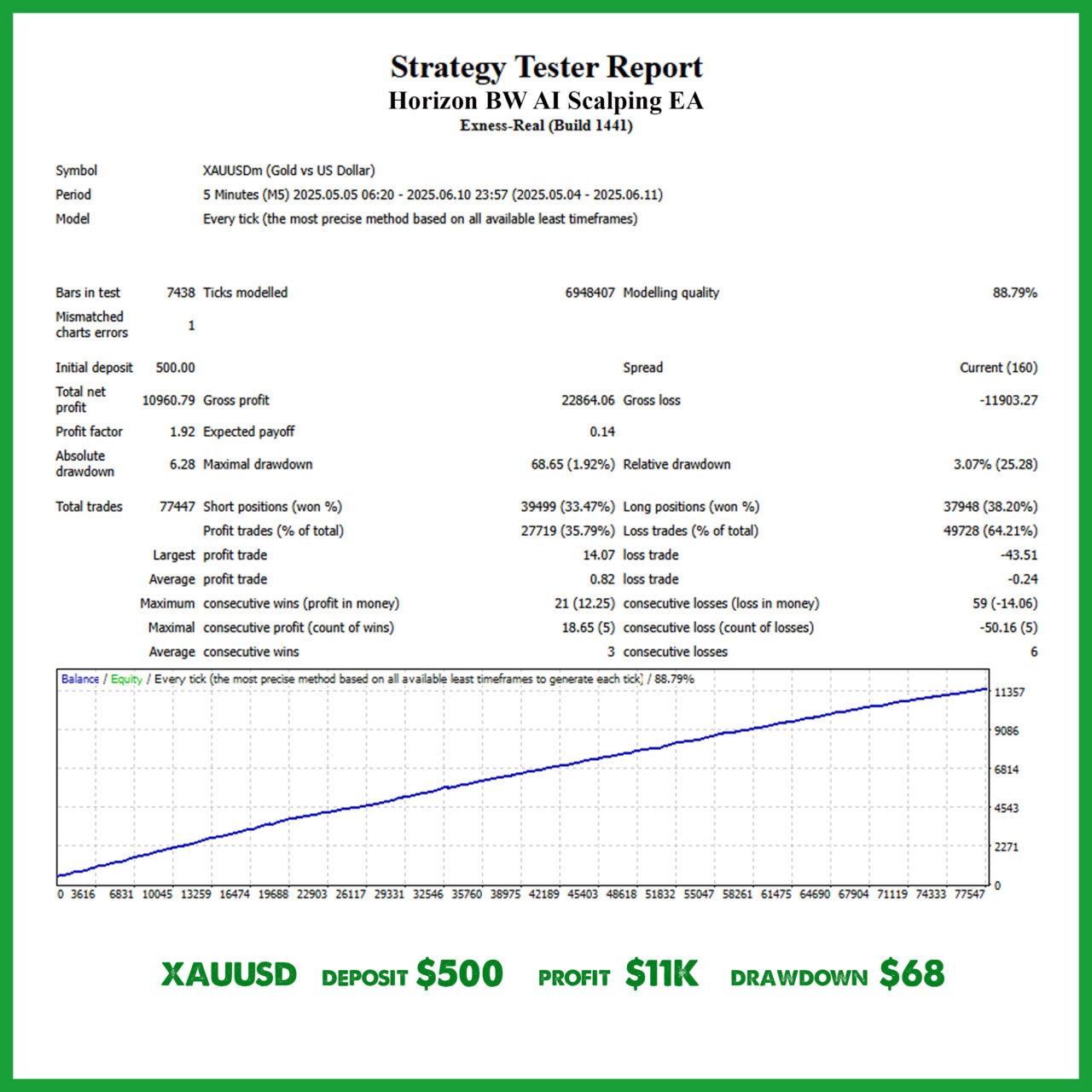

Horizon BW AI Scalping EA: Hedging Robot for MT4

30 in stock

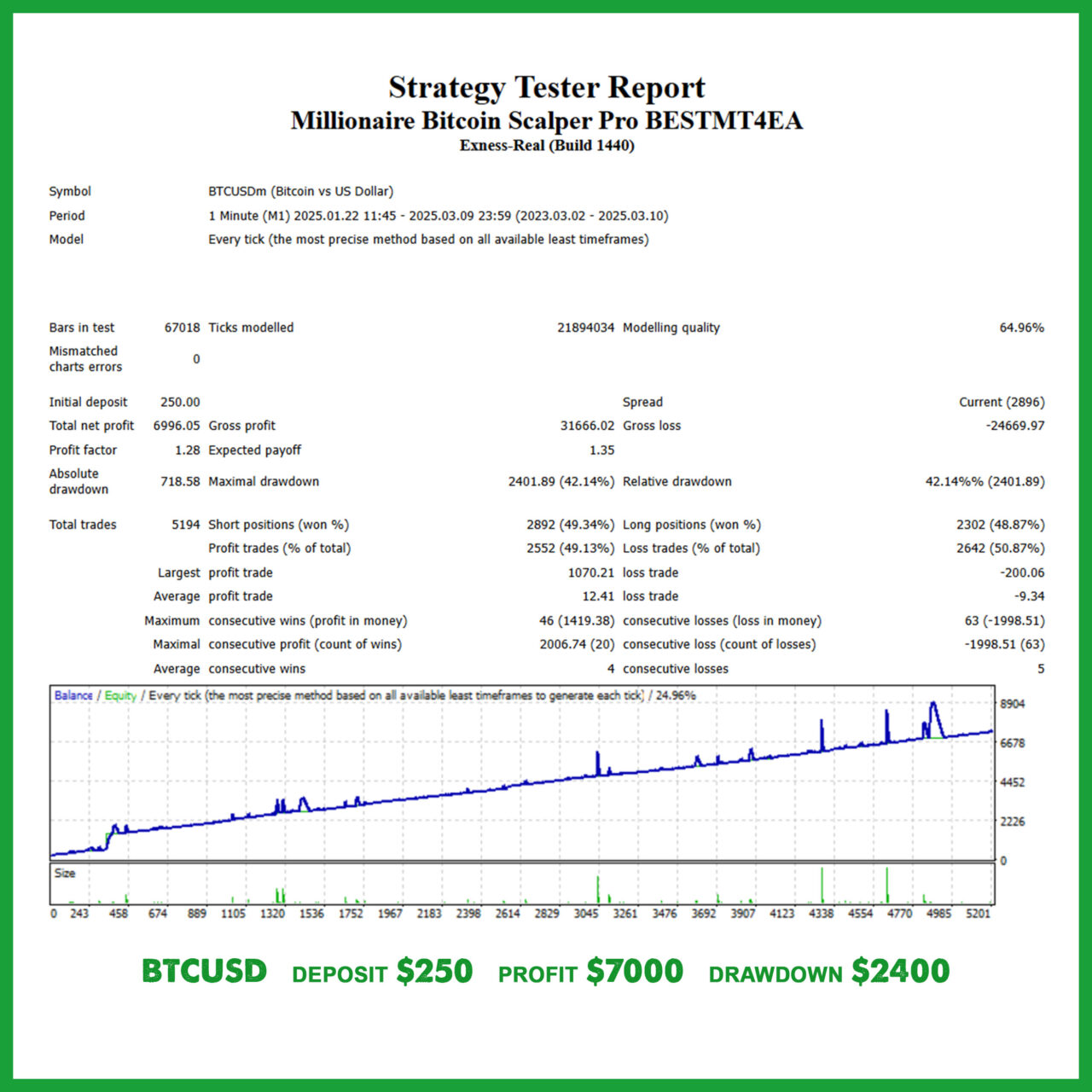

$18.99 – $278.99Price range: $18.99 through $278.99Millionaire Bitcoin Scalper Pro EA: AI-fueled 4D Nano Scalper for MT4

20 in stock

$29.99 – $987.99Price range: $29.99 through $987.99Powerful Forex VPS for MT4 & MT5 – Best Price

183 in stock

$44.99 – $359.99Price range: $44.99 through $359.99Top 2000 Trading Tools for Forex Success in 2025 (EA & Indicator)

In stock

TradingView: The Ultimate Guide to the Charting Tool Every Trader Needs

Let’s be honest. When you first start trading, the default chart your broker gives you feels… a bit clunky. It’s like trying to navigate a new city with a map from the 90s. It technically works, but you know there’s a better way.

You see sleek charts on Twitter and YouTube with custom indicators, intricate drawings, and a level of clarity that makes your current setup look like a child’s crayon drawing. Where are they getting these? Nine times out of ten, the answer is TradingView.

But what is it, really? Is it just a prettier picture, or is there some serious horsepower under the hood? Grab a coffee, and let’s break it down. This isn’t just another software review; this is the guide I wish I had when I started.

What Exactly *Is* TradingView? (And Why You Should Care)

At its core, TradingView is a web-based stock charting software and social network. But that’s a massive understatement. It’s more like a Swiss Army knife for anyone looking at financial markets—stocks, crypto, forex, you name it.

Think of it as the ultimate technical analysis platform. It combines:

- Powerful, intuitive charts: These are the star of the show. They’re fast, beautiful, and endlessly customizable.

- A massive social network: A place for traders to share ideas, scripts, and analysis. (More on this later, with a word of caution).

- A powerful analysis engine: Tools like a market screener, economic calendars, and news feeds are all built right in.

Why should you care? Because having the right tool for the job makes all the difference. You wouldn’t build a house with just a hammer, and you shouldn’t navigate the markets with a subpar chart. TradingView gives you the clarity to see what’s happening and the tools to plan your next move.

Getting Started: A No-Sweat Guide for Beginners

Diving into a new platform can feel overwhelming. So many buttons, so many options. But getting started with TradingView is easier than you think. Let’s walk through the basics with this mini how to use tradingview for beginners guide.

The Anatomy of the Chart

When you first load it up, you’ll see a few key areas:

- The Toolbar (Left): This is your creative toolbox. Trend lines, Fibonacci retracements, text notes, patterns—it’s all here.

- The Main Chart (Center): This is your canvas. Where you’ll spend 90% of your time.

- The Watchlist (Right): Keep an eye on all your favorite assets, from EUR/USD to Bitcoin to Tesla.

Just spend five minutes clicking around. You can’t break anything. Draw a line. Add an indicator. Get a feel for how responsive it is. It’s built for exploration.

Paper Trading: Practice Without the Pain

Here’s a feature every new trader should use. Buried in the tabs at the bottom of the chart is the “Trading Panel.” Connect to “Paper Trading by TradingView,” and you get a practice account with simulated money.

This is your personal sandbox. Want to test a new strategy? Do it here. Curious about how a specific indicator works? Try it risk-free. This simple tradingview paper trading tutorial is your first step: connect to the paper trading panel and place a trade. That’s it. You’re now practicing like the pros, protecting your capital while you learn.

The Power Features That Change the Game

Okay, you’ve got the basics down. Now for the fun stuff—the features that make traders choose TradingView and never look back.

Indicators Galore (And How to Find the Best Ones)

TradingView comes loaded with hundreds of built-in indicators, from the simple Moving Average to the complex Ichimoku Cloud. But the real magic is the Community Scripts library. Here, thousands of developers and traders share their custom-built indicators.

Looking for the best tradingview indicators for forex? You can search the library for things like “supply and demand zones” or “session ranges” and find dozens of free tools. For those of us who develop automated strategies (like Forex EAs), this library is an endless source of inspiration and foundational logic. It’s a goldmine.

Alerts That Actually Work for You

This is a big one. You can’t be glued to your screen 24/7. TradingView’s alerts are incredibly powerful. Don’t just set an alert for a price. You can set an alert for when a trend line is crossed, when one moving average crosses another, or when an indicator (like the RSI) enters an oversold condition.

The “how to set alerts on tradingview” process is simple: click the alarm clock icon on the right, set your condition, and choose how you want to be notified (pop-up, email, app notification). It’s like having a personal assistant watching the charts for you.

Pine Script: Your Secret Weapon

Ever had an idea for an indicator that doesn’t exist? With Pine Script, TradingView’s proprietary programming language, you can build it yourself. It was designed to be relatively easy to learn, especially for those with some coding background. This is how all those custom tools in the community library are made. It’s the ultimate tool for making the platform truly your own.

TradingView Free vs. Paid: The Big Question

Ah, the classic dilemma. Do you stick with the free version or open your wallet? This is where the tradingview free vs paid plans debate gets interesting.

- The Free Plan: Honestly, it’s incredibly generous. You get access to the amazing charts, most drawing tools, and the social features. The catch? You’ll have some ads, and you’re limited to 3 indicators per chart and 1 active alert.

- The Pro Plans (Pro, Pro+, Premium): This is where the limitations disappear. More indicators per chart, dozens of active alerts, multiple chart layouts, and no ads.

So, is tradingview pro worth it? Here’s my take: start with free. Use it until you hit a wall. You will *know* when you need to upgrade. It’s not a guess. It’s when you find yourself saying, “I really wish I could set one more alert” or “I need to see these two indicators together.” That’s your sign. For any serious trader, the Pro plan quickly pays for itself in saved time and missed opportunities.

Beyond the Charts: The Social Side of Trading

TradingView isn’t just a tool; it’s a community. You can follow other traders, browse thousands of published “Ideas” (analyses on specific assets), and even watch live streams. It’s a fantastic place to see how other people approach the market and get new perspectives.

But—and this is a big but—be careful. For every brilliant analyst, there are ten people posting nonsense. Use it for inspiration, not as a signal service. The best ideas on TradingView teach you *how* to think, not *what* to think.

The Verdict: Is TradingView a Must-Have?

In a word: yes. Whether you’re a beginner figuring out what a candlestick is or a seasoned pro managing a complex forex strategy, TradingView offers a level of quality and functionality that is unmatched by most other platforms, especially web-based ones.

It flattens the learning curve by making sophisticated tools accessible and intuitive. It grows with you—from the free plan for learning the ropes to the premium plans for managing a serious trading business. Stop struggling with clunky software. Give the free version a try. You’ll wonder how you ever traded without it.

Frequently Asked Questions (FAQ)

Can you trade directly from TradingView?

Yes, you can. TradingView integrates with a number of brokers. You can connect your brokerage account (if supported) and place live or paper trades directly from the charting interface, which is a fantastic feature for streamlining your workflow.

Is the data on TradingView accurate and in real-time?

For most forex and crypto markets, the data is real-time and highly accurate, even on the free plan. For some stock markets, real-time data might require a small monthly fee paid to the exchange, otherwise, it’s often delayed by 15 minutes. However, their data quality is generally considered industry-standard.

What is a good alternative to TradingView?

While TradingView is a leader, there are alternatives. For desktop software, platforms like MetaTrader 4/5 are popular in the forex world, though their charting is less modern. Other web-based platforms like TrendSpider or Koyfin offer different feature sets, with TrendSpider focusing on automated analysis and Koyfin on financial data dashboards.

About Daniel B Crane

Hi there! I'm Daniel. I've been trading for over a decade and love sharing what I've learned. Whether it's tech or trading, I'm always eager to dive into something new. Want to learn how to trade like a pro? I've created a ton of free resources on my website, bestmt4ea.com. From understanding basic concepts like support and resistance to diving into advanced strategies using AI, I've got you covered. I believe anyone can learn to trade successfully. Join me on this journey and let's grow your finances together!

View all posts by Daniel B Crane